Future of Restaking with Karak Network

A Deep Dive into Karak's Innovative Approach, Different Strategies, and Potential Risks

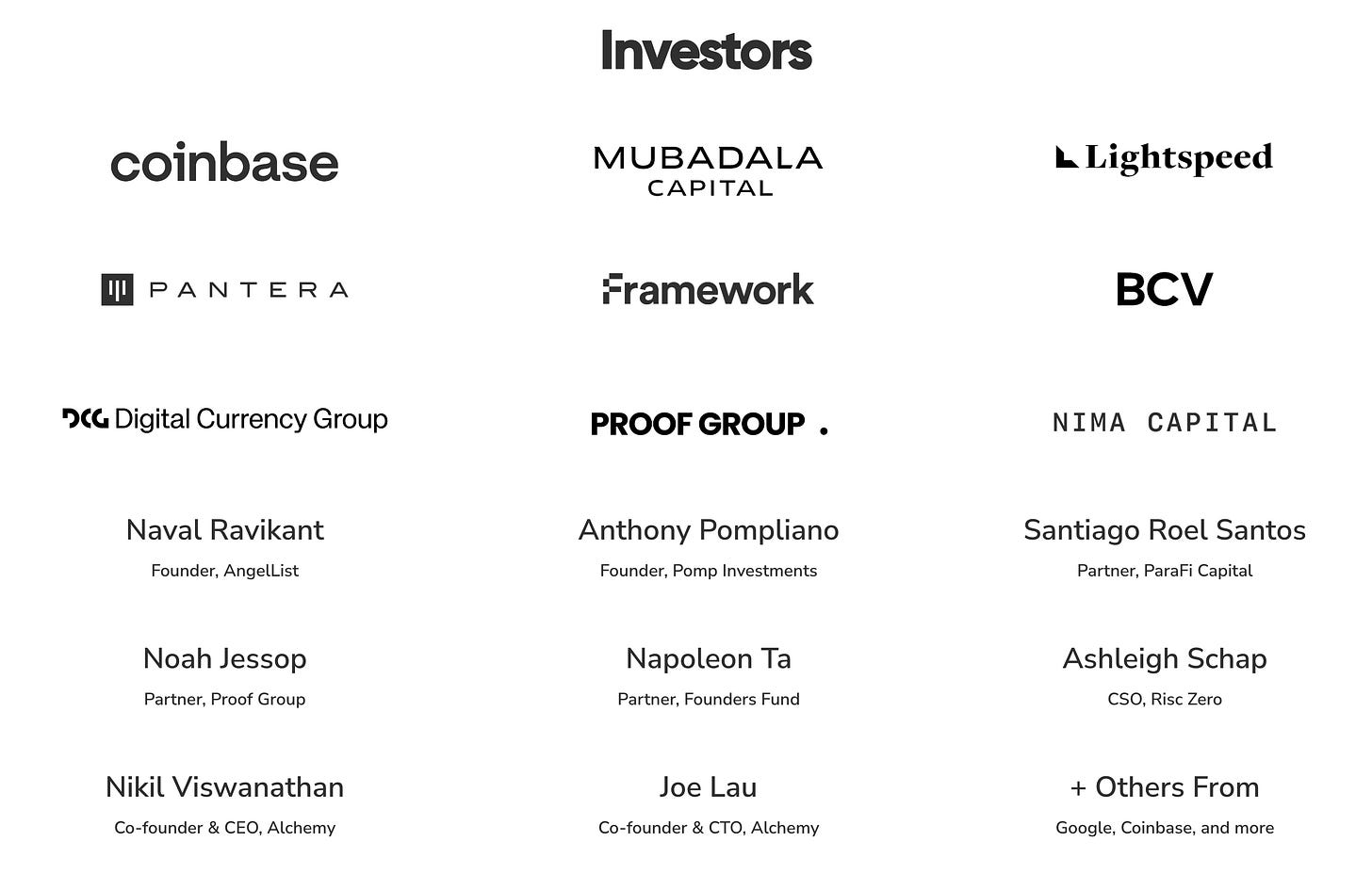

Today, I want to talk about Karak Network, a new entrant in the restaking ecosystem, backed by major names such as Coinbase Ventures, Pantera Capital, Framework, Lightspeed Venture Partners, Digital Currency Group, and many more. I see a lot of potential in Karak, that's why I chose it for today's newsletter. We will discuss how to use Karak, and we'll move also on to the strategies how to make more “airdrop money” on top of EigenLayer while getting our beloved Pendle involved as well. Currently, access to the protocol is private and requires invitation codes, which I'll share in this article. I'll cover protocol functionality, team information, security, investors, partnerships, going over strategies, and finally wrapping things up at the conclusion. As of now, the protocol boasts a TVL of $753.58 million.

Karak Network is a universal restaking layer designed to provide cryptoeconomic security with any asset, opening up new possibilities for developers to create innovative and secure infrastructure. By allowing protocols to leverage robust and secure trust networks from the outset, Karak significantly reduces the barriers to securing new protocols and eliminates the need for highly dilutive reward mechanisms.

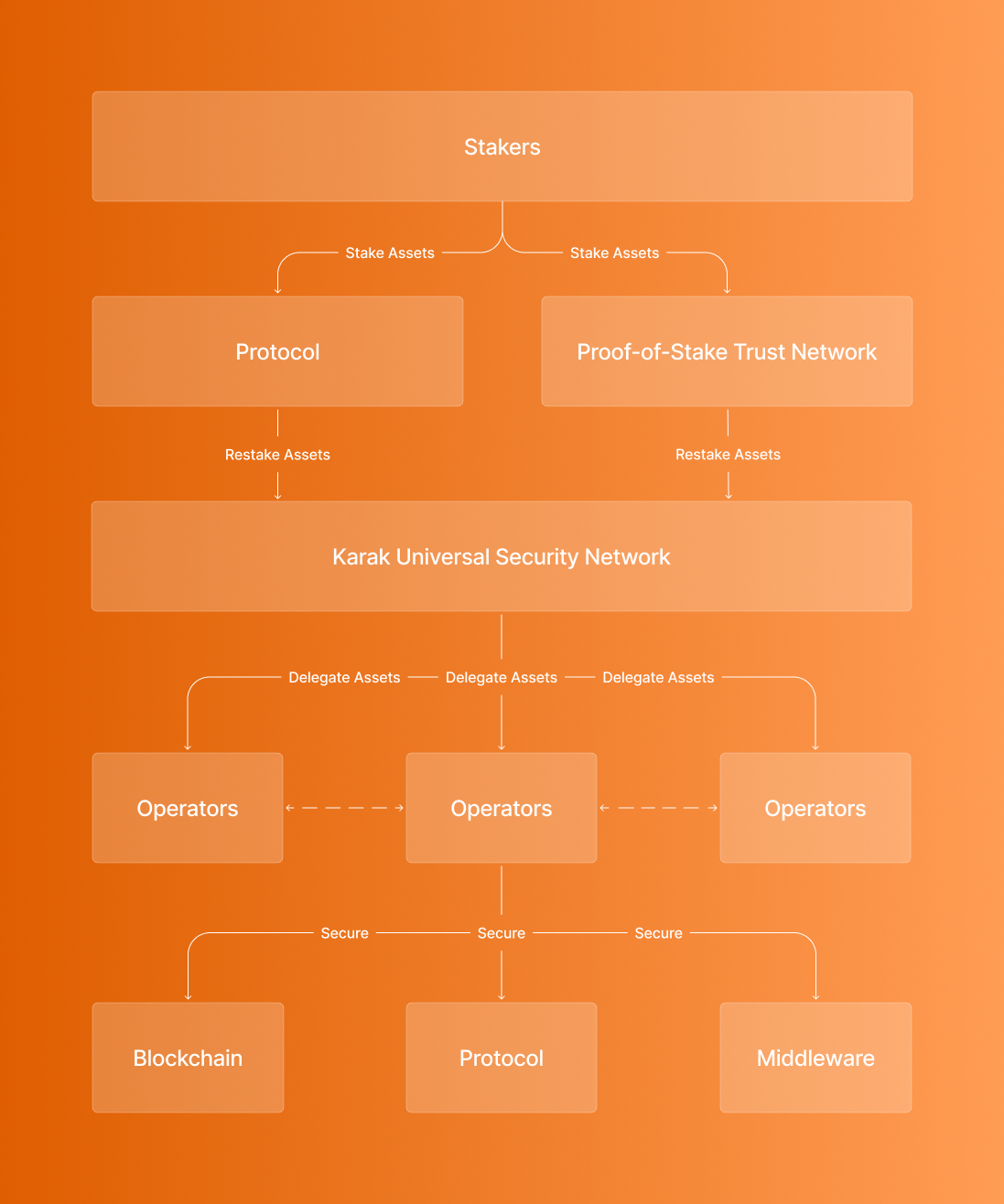

Functioning of Protocol

Karak Network allows users to repurpose their staked assets, extending Ethereum and other trust networks' security to various applications. Stakers allocate their assets to a Distributed Secure Service (DSS) on the Karak Network, granting additional enforcement rights and creating slashing conditions that ensure the security of applications utilizing Karak. The protocol operates as a marketplace where developers incentivize validators to allocate their restaked assets to secure their services.

Karak's universal restaking layer enhances the process of bootstrapping and improves composability across different blockchain networks. By introducing a multi-asset restaking model, Karak helps standardize capital requirements, despite the diverse staking parameters that exist across various blockchains.

Karak Vaults: Allow users to lock their assets and earn rewards while providing security to other applications.

Distributed Secure Services (DSS): Utilize restaked assets to enhance security and reduce operational expenses for various applications, such as data availability protocols, bridges, or oracles.

Multi-Asset Restaking: Enables users to restake various assets such as Ethereum, liquid staking tokens, stablecoins, and more, thereby earning rewards and enhancing security.

Business Model

Karak provides a decentralized platform that enhances security for new protocols and applications. The potential market size is significant, driven by the increasing adoption of DeFi, LSTs, LRTs, and the need for secure infrastructure. Karak's competitive advantages include its universal security layer and multi-asset restaking capabilities.

Unique Selling Propositions (USPs)

Multi-Asset Restaking: Karak allows users to restake various assets like Ethereum, liquid staking tokens, and stablecoins to earn rewards. By using a diverse mix of assets, Karak ensures that the failure of a single asset doesn't compromise the overall security of the system. This method helps create economically sustainable services without needing to issue highly inflationary rewards.

Restake Anywhere: Karak lets developers build products where their users are, without being limited to specific infrastructure. Currently, accessing restaking infrastructure beyond Ethereum mainnet is complex and expensive. Karak's design allows restaking infrastructure to be easily deployed on any blockchain, making it secure and flexible for developers.

Turnkey Development: Karak provides developers with tools and SDKs to quickly create and deploy secure services. With Karak's robust trust network, developers can extend or build new functionalities for their applications from day one. Karak's K2 network allows for experimentation and development of new services with a steady pool of restaking capital.

Governance, Operations & Team

Governance

Karak is an evolving project that prioritizes continuous, iterative improvements to the security mechanisms protecting its mainnet users. The Karak Protocol strives to be clear and transparent about the security of Karak mainnet and the Karak Protocol as a whole.

Operations & Pauser

Karak’s operational framework includes a team multisig with seven signers located globally. For standard operations, upgrades, and maintenance, the multisig requires the approval of 4 out of 7 signers. This multisig controls a timelock, which in turn owns the core contracts. To maximize security, this timelock enforces a minimum delay period of 2 days before any changes can be implemented.

To ensure quick responses in emergency situations, four team wallets are designated with a manager role. These wallets have the authority to pause the Karak contracts but hold no other privileges, ensuring that pauses can be enacted swiftly without compromising other aspects of the protocol.

Karak Team

Comprises experienced professionals from top companies such as Coinbase, Google, AWS, Microsoft, Twitter, and Goldman Sachs.

Token Utility & Tokenomics

Karak currently doesn't have a token but offers an XP program for a future airdrop.

Karak XP Program

Restaking Assets: Earn more XP by restaking your assets sooner and for longer periods.

Referrals: Use invite codes to refer others and earn 10% of the XP your referrals accumulate.

Additional XP Opportunities:

Participate in Discord activities.

Create content like articles and memes.

Future Outlook & Plans

Karak plans to introduce several Distributed Secure Services and expand its restaking infrastructure across various blockchain networks. Their plans include enhancing security, increasing user adoption, and enabling innovative infrastructure designs.

Security

Karak prioritizes security, with the development team and third-party auditors ensuring the protocol meets high security standards. Recent audits include:

Renascence Labs: April 1, 2024

Pashov Audit Group: April 14, 2024

Investors & Partnerships

Karak has raised $48 million at a $1 billion+ valuation from top investors to support its development and expansion. The protocol's extensible design and robust security features attract various blockchain projects and institutional investors.

Karak also has partnerships with prominent names in the space, such as EtherFi, Swell Network, Puffer, Bedrock, KelpDAO Magpie, Mantle, Pendle, Spark, and Frax Finance.

Competition

Karak differentiates itself through its multi-asset restaking capabilities, universal security layer, and turnkey development for secure applications. It stands out for its innovative approach and comprehensive product suite.

Karak also differs with its unique K2 Layer 2 (L2) for risk management and as a sandbox for Distributed Secure Services (DSS) to develop and test their services before launching on Layer 1 (L1), making development more affordable and flexible.

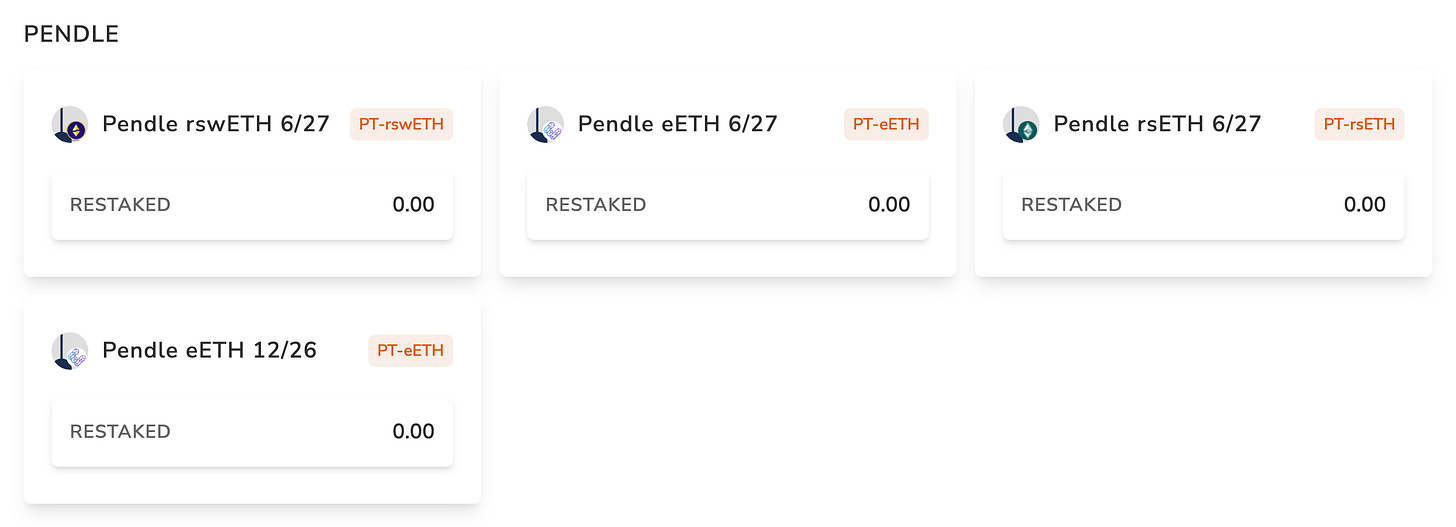

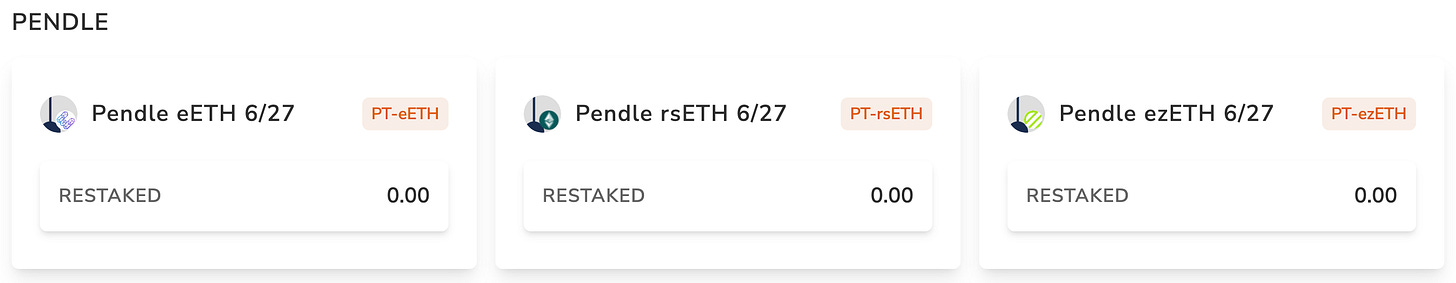

Strategies

As I mentioned in the introduction, Karak is a great opportunity to leverage your airdrop profits. Karak is possible to be composable with Pendle, and it’s PT tokens. I will share a strategy where you can earn all benefits from the Pendle’s PT and on top of this farming Karak XP. Strategy is very straightforward so let’s look at it.

Get an Invitation Code: Use one of my codes (8SMpJ, cHEOe, lsGRJ, 16zc0, iXzxo) or get one from someone else.

Deposit ETH: Deposit your ETH into EtherFi, Swell, Kelp, or Renzo LRT protocols.

Buy PT on Pendle: Purchase a PT on Pendle supported by Karak Network. You can choose from pools on Ethereum or Arbitrum.

Deposit PT: Deposit your PT to enjoy all its benefits and earn 1x Karak XP as a bonus.

Rewards:

Fixed APY from PT

EigenLayer points

LRT points

Karak XP

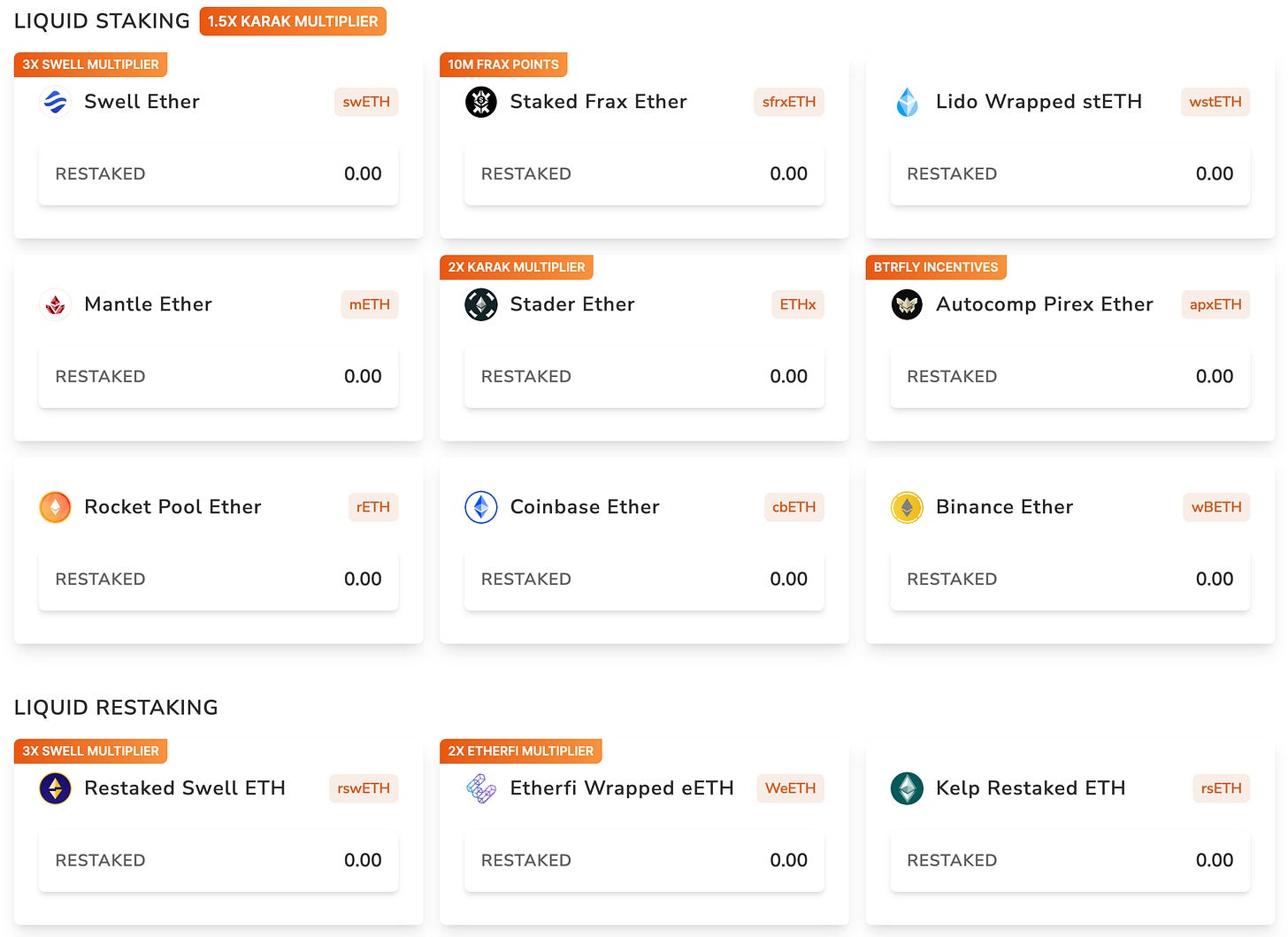

Another way to use Karak is to stake liquid staking tokens, liquid restaking tokens, stablecoins, or even wBTC. Keep in mind, there is a 7-day queuing period which cannot be reversed, after which you can withdraw.

Potential Risks & Considerations

Multiple Smart Contract Risks: Using Karak involves multiple smart contracts, each with its own risks.

New Technology: Liquid restaking is still a new concept and may have unforeseen issues.

Unstaking Period: Once you click "Unstake," the process takes 7 days for security reasons. During this period, you cannot reverse the decision and will stop earning points.

Withdrawal Time: Withdrawing assets from Karak L2 back to Ethereum Mainnet takes 3 days via the K2 bridge.

More Risks: Market Risks, Regulatory Changes, Technological Challenges.

Thank you for reading. I will be very pleased if you support me with your subscription.

Not financial or tax advice. This article is for informational purposes only and should not be construed as tax or financial advice.