Time to Farm Smart, Not Hard #10

Top Yield Opportunities Across 7 Blockchains: Earn Double to Triple-Digit APRs

Hello, farmers! Welcome to the 10th edition of "Time to Farm Smart, Not Hard"! A big thank you to all the supporters who've been with me on this journey. We've hit some great milestones together – including reaching 1,000 followers on X! And there's so much more ahead. I'm constantly working on new content and fresh ideas. Also, don't miss my new Substack newsletter "A Million Dollars' Worth of Knowledge #1", which comes out every Tuesday and is loaded with alpha knowledge.

I've decided that this will be the last edition of "Time to Farm Smart, Not Hard" as a Substack article. From now on, I'll continue the series as a thread on X. It's been a fantastic journey that helped me develop consistency in creating this newsletter series – 10 articles over 10 weeks, and this is just the start. I'm committed to developing even better content with more value for you in my newsletters, diving deeper into more complex topics in the future.

Now, let's delve into 10 yield farming opportunities across 7 different blockchains!

Pendle Finance (Ethereum)

Pendle Finance is a DeFi protocol for tokenizing and trading future asset yields. It offers a unique platform for users to speculate on future yield values by separating an asset into two tokens – one representing the principal and the other the expected yield. Pendle stands out with its time-decaying AMM, ensuring fair pricing for yield tokens and enhancing precise speculation on future yields.

eETH: 38.94% (+ 2x boost on EtherFi Loyalty Points)

crvUSD: 69.91%

DojoSwap (Injective)

DojoSwap, inspired by Uniswap, is an automated market-maker (AMM) protocol on the Injective blockchain. It facilitates decentralized, on-chain trading of diverse assets within the Injective ecosystem.

USDT / USDC: 113.84%

Without audit

Sommelier Finance (Ethereum)

Sommelier is built on the Cosmos SDK to maximize interoperability with other blockchains, and the platform is a reimagined gateway into interchain DeFi. With a bridge in place connecting the Cosmos-based platform to Ethereum, Sommelier will be able to execute strategies across multiple blockchains, opening a wide horizon of possibilities.

Turbo eETH: 12.53% (+ 1.5x boost on EtherFi Loyalty Points)

Turbo stETH: 11.7%

Real Yield ETH: 11.9%

Turbo stETH: 12.32%

Granary Finance (Metis)

Granary Finance is a decentralized non-custodial liquidity market protocol where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) fashion.

m.USDC: 80.85%

m.USDT: 80.85%

m.WBTC: 38.48%

Solv Protocol (Arbitrum)

Solv Protocol is a decentralized asset management platform offering high-yield opportunities through diverse strategies in DeFi, CeFi, and real-world assets. Launched in 2023, it features advanced security, including continuous monitoring and non-custodial controls. Solv is redefining professional asset management in DeFi, making institutional-grade investments accessible to all.

MUX USDT - A: 93.03%

GMX V2 USDC - A: 46.42%

Scallop Protocol (Sui Network)

Scallop is a leading peer-to-peer Money Market in the Sui ecosystem and the first to receive a grant from the Sui Foundation. Focused on top-quality, composability, and security, Scallop aims to provide a dynamic platform for high-interest lending, low-fee borrowing, AMM, and digital asset management. It also offers an SDK for professional traders.

SUI: 20%

USDC: 18.97%

USDT: 17.84%

Navi Protocol (Sui Network)

Navi is the first liquidity protocol on Sui, making it easy for users to be liquidity providers or borrowers. Providers can earn by supplying assets to the market, and borrowers can get loans in various assets. Navi’s goal is to be a big part of DeFi's growth in the Sui Ecosystem.

The protocol offers cool features like Automatic Leverage Vaults and Isolation Mode, helping users to use their assets wisely and find new trading chances with less risk.

USDT: 18.49%

USDC: 17.51%

SUI: 20.26%

Layer Bank (Manta)

LayerBank, a non-custodial on-chain lending protocol, aims to become a key liquidity hub for all EVM-based Layer 2 networks. It offers users full control over their funds and attractive interest rates in a decentralized, intermediary-free market. Embracing the advanced ve3,3 token economics model, LayerBank is set for strong, sustainable growth, redefining standards in decentralized finance.

USDC: 17.68%

ETH: 18.19%

Canto Public (Canto)

Canto is a permissionless general-purpose blockchain running the Ethereum Virtual Machine (EVM). It was built to deliver on the promise of DeFi – that through a post-traditional financial movement, new systems will be made accessible, transparent, decentralized, and free.

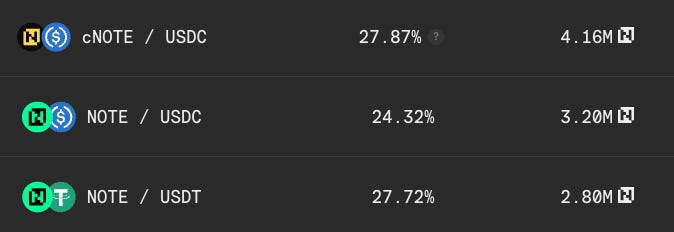

NOTE / USDC: 24.32%

NOTE / USDT: 27.72%

cNOTE / USDC: 27.87%

Hummus (Metis)

The Hummus Exchange protocol, a cutting-edge single-side AMM on the Metis blockchain, specializes in swapping stablecoins like USDT, USDC, and DAI. Built as a series of smart contracts, it focuses on censorship resistance, security, self-custody, and high capital efficiency. Hummus offers single-token provision to remove impermanent loss for providers and ensures ultra-low slippage for traders.

Tri Stable: 34.63%

That's a wrap! We've looked at 10 great places to farm yields, chosen just for you. It's been all about finding smart ways to earn more from your crypto in DeFi.

Let's keep growing our crypto together. Happy farming till next time!

This article is for informational purposes only and should not be construed as financial advice. Investing involves risk and you may lose some or all of your investment.