Time to Farm Smart, Not Hard #2

Yield Farming: The Most Lucrative Job Since 2020. Earn Over 100% Yield with Stablecoins on the Leading Arbitrum Protocol. Let's Look at 10 High-Potential Farms with Minimal Risk of Impermanent Loss.

Introduction

Hey farmers, welcome back to the 'Time to Farm Smart, Not Hard' series. I hope you found the first article interesting and are ready for the other opportunities yield farming has to offer.

I understand that the world of DeFi and yield farming can sometimes feel like a bit of chaos. That's why, just like in the first article, I've done all the hard work for you - researched, analyzed, and simplified everything so that it's easy to understand and use.

I've tried to pick the best opportunities in terms of risk and return. Of course, there is always risk; no investment is risk-free, so always opt for sensible risk and money management.

Let's explore these 10 yield farming opportunities that are too good to ignore.

1. Vaultka (Arbitrum)

Vaultka stands out as a key DeFi protocol, sparking growth in the Decentralized Perpetual Exchange market on Arbitrum. Recognizing trading as crucial to the crypto world, Vaultka focuses on delivering sustainable profits through its platform. With Arbitrum's rapid expansion in decentralized trading, Vaultka aims to lead this space by offering specialized products and services tailored for these exchanges.

Lending Pools:

USDC.e: 116.23% (5.5% USDC & 110.73% esVKA)

USDC: 109.55% (10.76% USDC & 98.58% esVKA)

Note: After you deposit into the lending vault, you will receive a s-WATER or V2-WATER token. This token must then be staked in the 'earn' section of the Vaultka platform. To boost your earnings, it's important to stake either $VKA or $esVKA.

2. Penpie (Ethereum, Arbitrum)

Penpie is a new DeFi platform that helps Pendle Finance users earn more and boost their veTokenomics. It works with Pendle Finance to lock PENDLE tokens for better yields and governance rights. Penpie makes it easier for users to get the most out of their investments and use their governance power for profit.

mPendle staking (Ethereum): 36.66%

mPendle staking (Arbitrum): 11.37%

3. Prisma Finance (Ethereum)

Prisma is a new DeFi tool focused Ethereum liquid staking tokens (LSTs). It lets users mint a stablecoin, mkUSD, backed by these LSTs. This stablecoin works well with Curve and Convex Finance, allowing users to earn extra rewards and fees. Prisma is built to be unchangeable and safe.

mkUSD stability pool: 12.03%

Stablecoin LPs: up to 20.87%

Note: APR are without boost.

4. Curve (Kava)

Curve Finance is DeFi's leading AMM DEX. Hundreds of liquidity pools have been launched through Curve's factory and incentivized by its DAO. Users rely on their proprietary formulas to provide high liquidity, low slippage, and low-fee transactions between ERC-20 tokens. Launched in 2020, the protocol has quickly gained popularity in the decentralized finance (DeFi) ecosystem due to its unique approach to liquidity provision, and its ability to offer traders low fees and low slippage.

axlUSDT / USDt (Kava): 10.23%

5. Gearbox (Ethereum)

Gearbox Protocol lets you use DeFi-native leverage across different platforms, like Uniswap, Curve, Convex, Lido, and more. It allows you to customize your investment strategy. You can take leverage from Gearbox and apply it to your favorite protocols for activities like leverage trading, farming, creating delta-neutral strategies, hedging, or even as leverage for structured products.

DAI: 9.83%

USDC: 9.77%

wETH: 5.36%

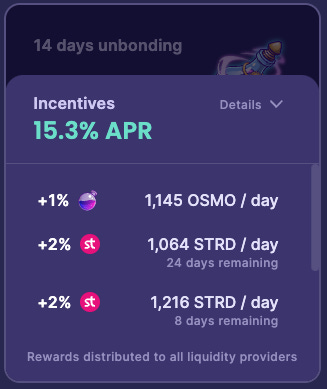

6. Osmosis (Cosmos)

Osmosis is a decentralized exchange (DEX) and automated market maker (AMM) protocol for the Cosmos ecosystem. It allows users to swap assets between Cosmos chains and other blockchain ecosystems, with low fees and low slippage. Osmosis also offers a variety of other features, such as liquidity pools or staking.

ATOM / stATOM: 15.3%

Note: Additional gain on the stATOM LST position.

7. GMX (Arbitrum)

GMX is a decentralized exchange for spot and perpetual trading, built on the Arbitrum and Avalanche networks. It offers high speed and low fees, perfect for quick and easy transactions. GMX focuses on being decentralized, fair, and efficient, with high liquidity, strong security, and transparency. It's ideal for traders who want a reliable DEX to trade crypto assets without a central authority. Users benefit from having control over their funds, privacy, and minimal slippage when trading.

GM Pools: up to 61.19%

Note: The GM pool is the counterparty to traders, if traders make a profit that comes from the value of the GM pool.

8. Archi Finance (Arbitrum)

Archi Finance is composable leveraged yield farming protocol. It has two sides to it: passive liquidity providers who earns low risk interests by supplying single-asset liquidity; and degen farmers who borrow those assets to achieve a higher APY. GMX will be the platform Archi integrated in v1.

ETH / wETH: 11.25%

USDT: 18.78%

USDC.e: 18.8%

BTC: 4.58%

wstETH: 10%

rETH: 16.16%

Caution: Archi Finance has not yet been audited.

9. TimeSwap (Arbitrum, Mantle)

Timeswap is the first lending/borrowing protocol without oracles, allowing money markets for any ERC-20 tokens. Its loans are non-liquidatable and fixed-term. Without oracles, it avoids risks of manipulation common in DeFi. Timeswap supports a wide range of tokens and is live on Arbitrum, Mantle, Polygon PoS, Polygon zkEVM, and Base.

Boosted lending pools: up to 41.83%

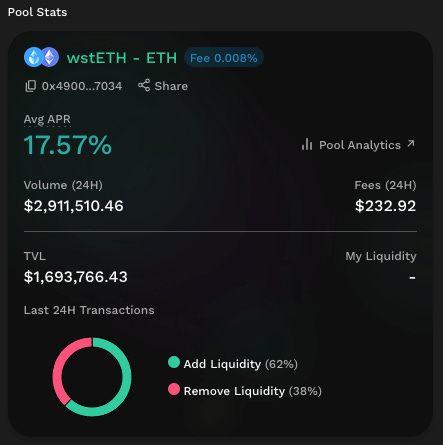

10. KyberSwap (Arbitrum)

KyberSwap is the crosschain DEX & aggregator on 15 chains enabling users to trade smart and maximize earnings.

wstETH / ETH: 17.57%

That's a wrap! We've looked at 10 great places to farm yields, chosen just for you. It's been all about finding smart ways to earn more from your crypto in DeFi.

Let's keep growing our crypto together. Happy farming till next time!

This article is for informational purposes only and should not be construed as financial advice. Investing involves risk and you may lose some or all of your investment.

An interesting series of articles on DeFi. It definitely broadens my horizons on where I can further invest my resources without having to search for interesting protocols myself.

Keep it up, Keno. I'm rooting for you to succeed and to write more such interesting articles for us.