Hello farmers, and a Happy New Year to you all! May this year bring rich harvests and turn your seeds into fulfilled dreams.

I see a lot of time, many people fear high APRs due to the Terra crash, but remember, that was more about an unstable algorithmic stablecoin, not the APR itself.

Today, several protocols offer real yields derived from platform usage fees. Plus, many platforms often provide higher rewards in tokens incentives or through special campaigns, like Arbitrum's STIP.

Yes, there's always a smart contract risk, but don't assume that high APRs are doomed to fail like Terra. We're in an era of fantastic farming opportunities across various blockchains.

Today, we'll explore the top 10 farms offering steady yields without impermanent loss, spread across Manta, Osmosis, Arbitrum, Metis, Kujira, Stacks, and Sui.

Let's dive in my frens!

Osmosis (Osmosis)

Osmosis is a decentralized exchange (DEX) and automated market maker (AMM) protocol for the Cosmos ecosystem. It allows users to swap assets between Cosmos chains and other blockchain ecosystems, with low fees and low slippage. Osmosis also offers a variety of other features, such as liquidity pools or staking.

USDT / USDC: 40.2%

Abracadabra (Arbitrum)

Abracadabra.money issues stablecoin loans in magic internet money (MIM) by collateralizing interest bearing tokens. You can borrow, leverage or earn yield on one place.

MIM / USDC / USDT: 33.66%

I cannot find any information about audit.

Netswap (Metis)

Netswap offers a great DeFi trading experience, combining ease of use with powerful tools. It's the go-to multi-functional Decentralized Trading Platform exclusively on Metis Andromeda (Layer 2), perfect for maximizing your yield.

m.USDT / m.USDC: 31.4%

Kujira Bow (Kujira)

BOW on Kujira boosts earnings via LPs, redirecting trade fees from FIN back to providers. As a market-making framework, it enhances FIN trading pairs and lets anyone incentivize LPs, fostering a reward system for active users and a thriving ecosystem.

axlUSDC / USK: 22.44%

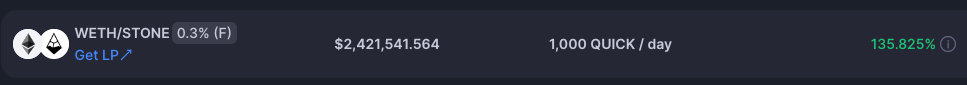

Quickswap (Manta)

QuickSwap, a leading DEX on Polygon PoS, Polygon zkEVM, and Dogechain, and now also on Manta is a community-driven platform offering the comprehensive DragonFi ecosystem of DeFi products. Known for its high-performance and cost-efficient platforms.

wETH / STONE: 135%

Bonus point: Lock your LP on StakeStone to start collect G-NFTs.

Vaultka (Arbitrum)

Vaultka stands out as a key DeFi protocol, sparking growth in the Decentralized Perpetual Exchange market on Arbitrum. Recognizing trading as crucial to the crypto world, Vaultka focuses on delivering sustainable profits through its platform. With Arbitrum's rapid expansion in decentralized trading, Vaultka aims to lead this space by offering specialized products and services tailored for these exchanges.

USDC: 44.7%

ETH: 35.3%

ARB: 22.3%

BTC: 24.4%

Hyperliquid (Arbitrum)

Hyperliquid is an on-chain perp DEX with an order book system. It matches top CEXs in functionality but operates entirely on-chain. Running on the Hyperliquid L1, a blockchain designed for performance with Tendermint consensus, it ensures transparency in every order, trade, and liquidation with less than 1-second block latency. The chain can handle 20,000 orders per second.

Hyperliquidity Provider (HLP): 255%

Dolomite (Arbitrum)

Dolomite is a new kind of decentralized market for lending and trading, supporting many tokens and using a virtual liquidity system for better capital use. It mixes a DEX and a lending platform, making it super efficient and flexible in DeFi. With Dolomite, you can get loans, trade on margin, do spot trading, and more.

DAI: 20.83%

jUSDC: 63%

USDC: 55.4%

Alex Lab (Stacks)

ALEX is a DeFi platform focused on enhancing Bitcoin's ecosystem, particularly through Stacks, Bitcoin's Layer 2.

sUSD / xUSD: 18.06%

Cetus (Sui)

Cetus, a leading DEX and concentrated liquidity protocol on Sui and Aptos blockchains, aims to create a robust liquidity network for easy trading across various assets. Its focus is on enhancing the trading experience and boosting liquidity efficiency for DeFi users through its concentrated liquidity protocol and a range of interoperable modules.

USDT / USDC: 21.4%

haSUI / SUI: 32.3%

vSUI / SUI: 27.5%

afSUI / SUI: 36.9%

Audit by OtterSec & Movebit

That's a wrap! We've looked at 10 great places to farm yields, chosen just for you. It's been all about finding smart ways to earn more from your crypto in DeFi.

Let's keep growing our crypto together. Happy farming till next time!

This article is for informational purposes only and should not be construed as financial advice. Investing involves risk and you may lose some or all of your investment.