Why I am Bullish on Pendle Tokenomics

A Deep Dive into the Excellent Tokenomics of the Pendle Protocol

Introduction

On April 28, 2021, Pendle kicked off with a liquidity bootstrapping event for its native token, $PENDLE. Initially launched as a pure utility token, $PENDLE's role has evolved significantly. Over time, it has become crucial for value accumulation and protocol governance, setting the stage for Pendle's ongoing development and growth in tokenizing and trading future yield.

Token Distribution

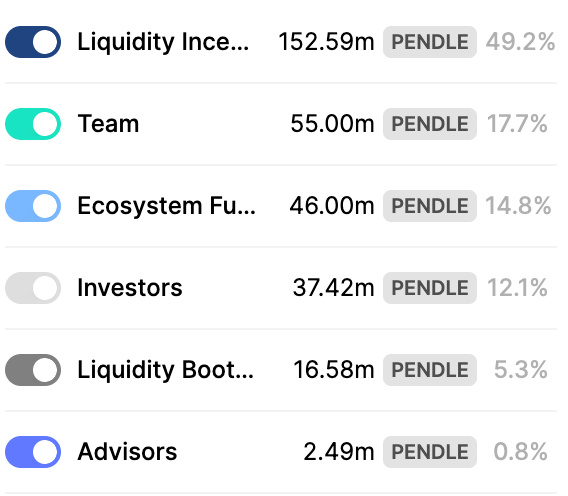

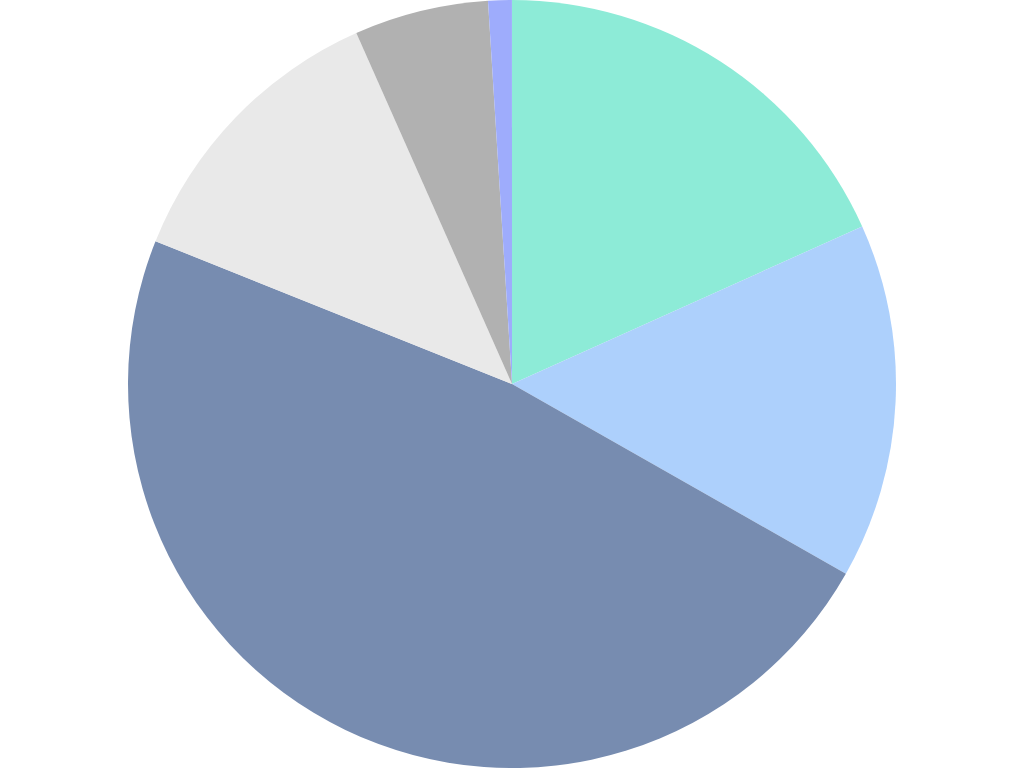

Pendle’s token distribution strategy focuses on decentralization and broad participation. Here’s how it breaks down:

Liquidity Incentives: A significant portion of tokens was allocated to incentivize liquidity, ensuring robust yield markets.

Team: These tokens, subject to a vesting schedule, align the team’s interests with the protocol’s long-term success.

Investors and Advisors: Early investors received tokens, but no single entity controls a substantial portion, with most holding less than 0.4% of the total supply. In the private round, investors can acquire $PENDLE for $0.14.

Ecosystem Fund: Reserved for future development and ecosystem growth.

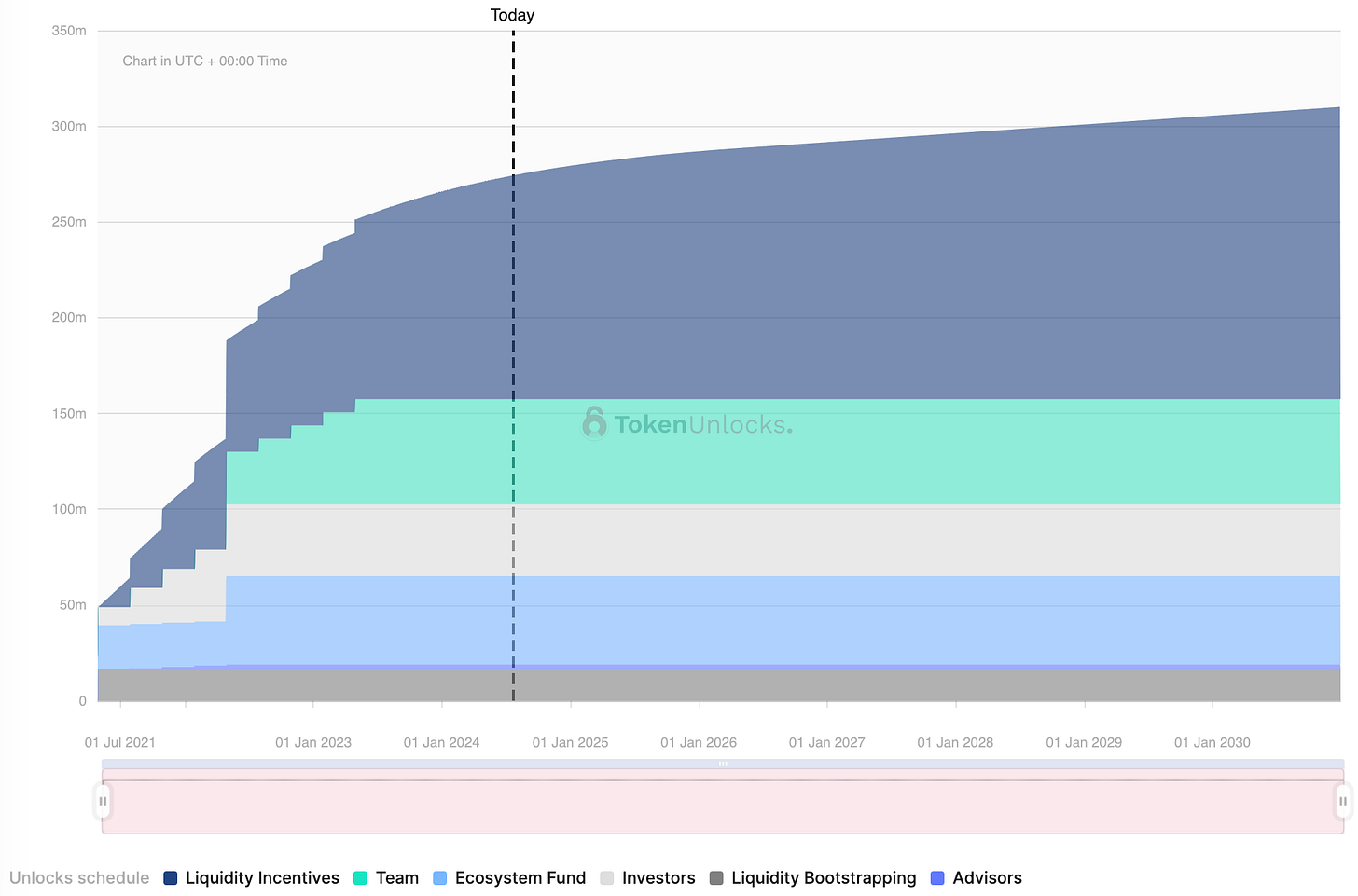

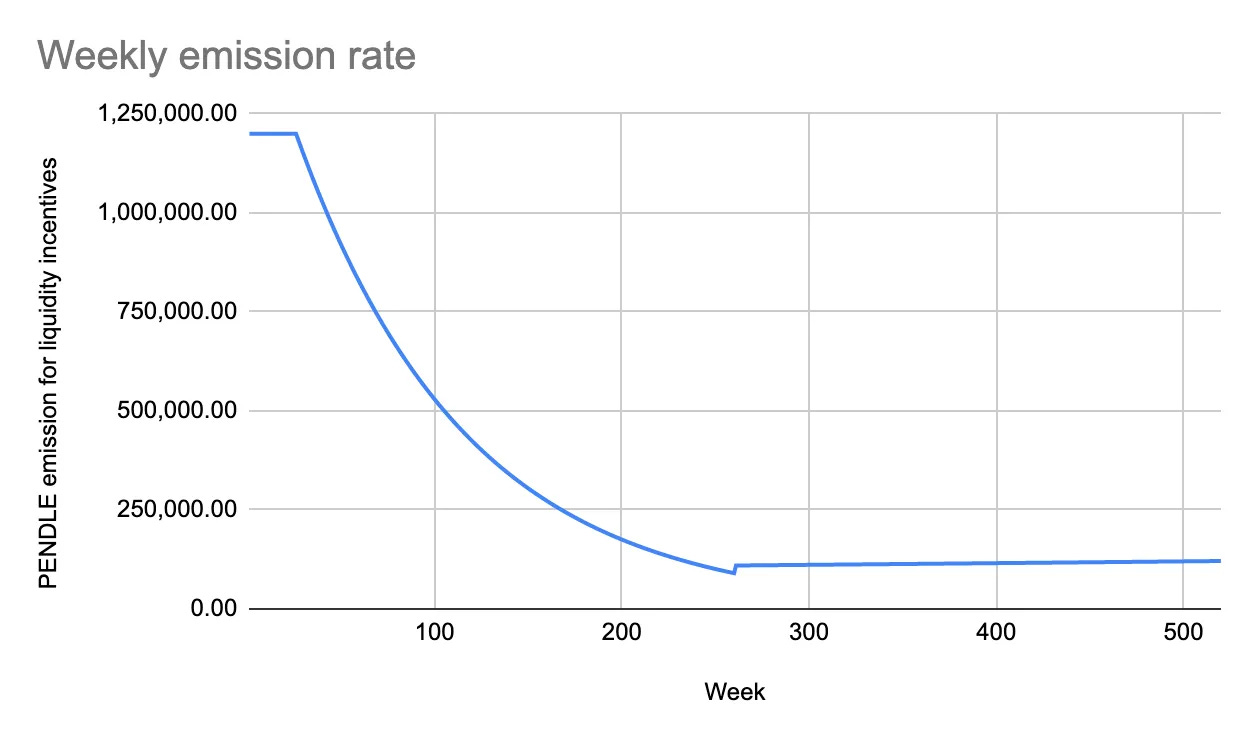

Pendle doesn’t have a max supply cap. Its hybrid inflation model features weekly emissions that decrease by 1.1% each week until April 2026, when a terminal inflation rate of 2% per annum, based on circulating supply, will take effect. At this point, all $PENDLE for team, investors, advisors, and ecosystem fund will have fully vested. The remaining tokens entering circulation will be for liquidity incentives.

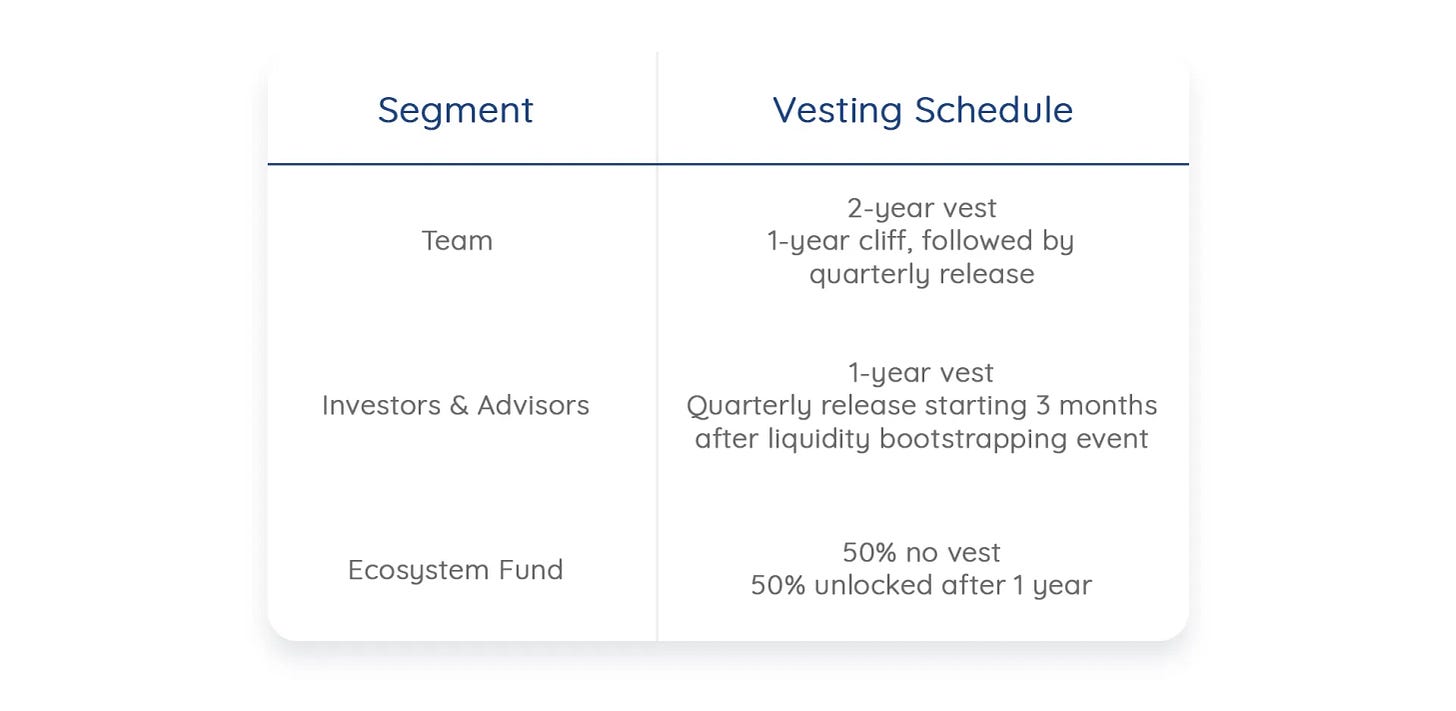

Vesting Schedule and Emissions

Currently in circulation is 156,16m of $PENDLE, while a total supply is 258,45m of $PENDLE.

Liquidity Incentives on all of the data charts above are projected until the end of the 2030s, based on an assumed annual inflation rate of 2% with a 1.1% decrease each week until April 2026.

Token Utility

$PENDLE serves multiple functions within the ecosystem, including

Governance

Staking

Providing token incentives.

Staking $PENDLE will get you vePENDLE, which comes with additional utilities such as:

Boosting Liquidity Provision APY up to 250%

Receiving a share of protocol revenue

Voting for pools to channel incentives

Earning swap fees from voted pools

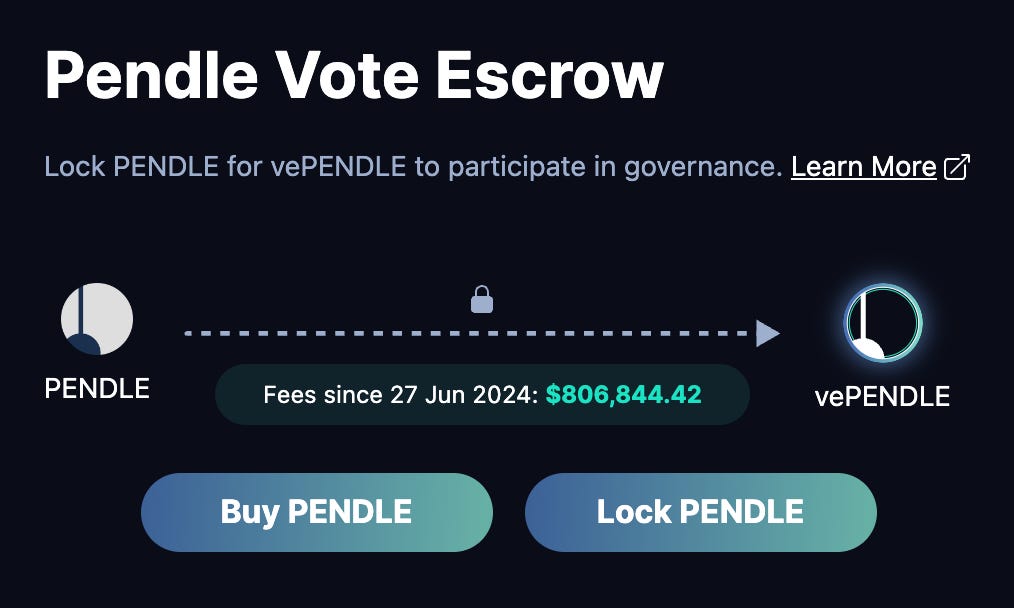

Revenue Sharing

Pendle distributes protocol revenue from YT fees to vePENDLE holders and all protocol revenue from swap fees to vePENDLE voters of the corresponding pools. Currently, all protocol revenue is distributed to vePENDLE holders, with no allocation to the Pendle treasury. In the future, a portion of this revenue might be redirected to the treasury.

Demand Drivers and Value Capture

The primary demand drivers for $PENDLE are governance and staking. Pendle’s ability to adapt to any narrative ensures it remains relevant, making staking $PENDLE highly lucrative. vePENDLE yields, paid in $ETH, are real yields based on protocol activity, distributed monthly.

Business Model

Pendle generates revenue through swap fees and YT fees, which are shared with vePENDLE holders. This model aligns token holders' interests with the protocol's success.

Governance

$PENDLE provides governance rights to vePENDLE holders, empowering them to vote on key protocol decisions and channel incentives. This decentralized governance ensures the protocol evolves according to the community’s consensus.

Currently, 55.24m $PENDLE is locked as vePENDLE, which is 36% ~ of the circulating supply, with an average lock period of 409 days.

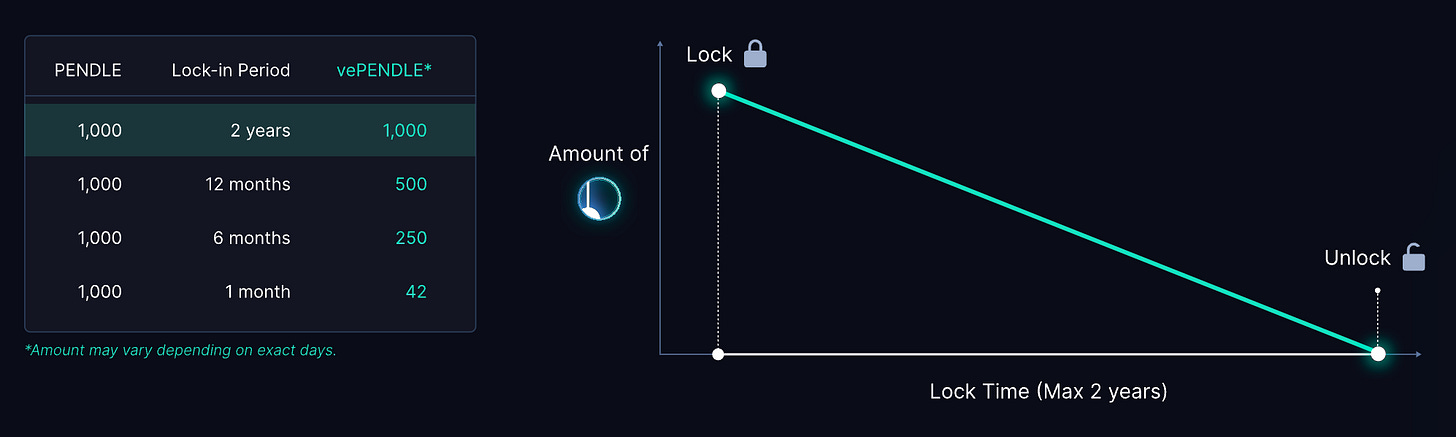

Lock-in Period

The amount of vePENDLE you receive is proportional to the quantity and duration of your $PENDLE lock. vePENDLE decays over time, reaching zero at the end of the lock duration, after which your locked $PENDLE is fully released.

Conclusion

Pendle's robust tokenomics and strategic distribution have set a strong foundation for its growth and sustainability. By providing multiple utilities for $PENDLE, Pendle ensures that its token remains valuable and attractive to both retail and institutional investors.

Many are interested in being part of the real yield in $ETH, which is extremely lucrative during periods of high activity on Pendle. Even in a calm market, this yield is very attractive! The numbers speak clearly - just last month, 438 $ETH rewards were distributed to vePENDLE holders and voters. If you overlook this, you might regret it. When the market gains hype again, and Pendle attracts even more traction, this number could significantly increase.

Pendle has many future narratives, such as Bitcoin ecosystem deployment, which is extremely bullish. In Q4, we can also look forward to Pendle V3. Make your own decision; this is just my humble view, but remember, dogs always want the best for their people. Institutional adoption is on the way because innovative yield trading is exactly what they want. Pendle is at the forefront of DeFi, and its tokenomics are designed to reach new heights.

Thank you for reading. I will be very pleased if you support me with your subscription.

Not financial or tax advice. This article is for informational purposes only and should not be construed as tax or financial advice.